An analyst estimates that following the halving, bitcoin miner sales could total up to $5 billion over the course of four to six months.

A market analyst believes that, similar to past cycles, there may be a significant withdrawal of Bitcoin from miners in the months that follow the halving.

Markus Thielen, head of research at 10x Research, calculated that following the halving, bitcoin miners might be able to liquidate $5 billion worth of BTC in an analyst note April 13.

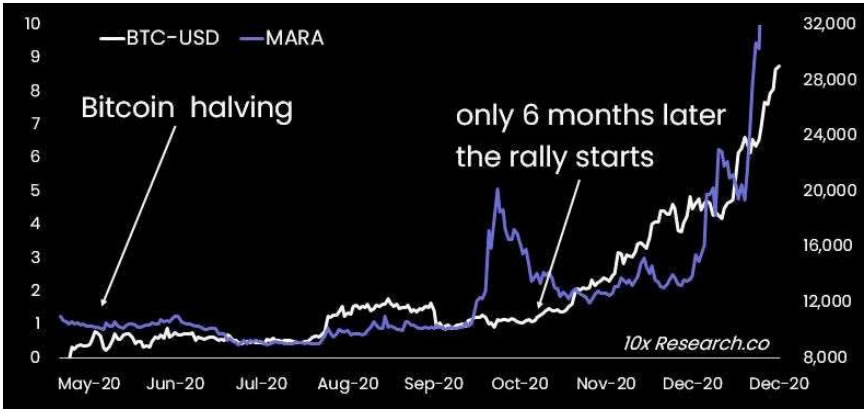

As it has done in the past after halvings, he continued, “the overhang from this selling could last four to six months, explaining why Bitcoin might go sideways for the next few months.”

Image source: CoinTelegraph

According to Thielen, the same might occur once more, with cryptocurrency markets perhaps seeing “a significant challenge in a six-month’summer’ lull.”

Within the $9,000 to $11,500 band, bitcoin values stayed stable in the five months that followed the 2020 halving.

This year, the halving is scheduled on April 20, which is only six days away. If history repeats itself, markets might not see a notable upward trajectory until approximately October.