Ethereum is almost at $4000, but could it hit it’s all time high to be at $5000?

Key take aways:

- Whales increased their purchases from exchanges and ETH exchange-traded funds (ETFs) on Wednesday, causing Ethereum (ETH) to rise 7%

- ETH may smash its all-time high resistance at $4,868 if the trend continues and it completes a cup and handle pattern

Ethereum’s on-chain coin flows show that whales are exerting significant buying pressure on exchanges. With seven days in a row, Ethereum ETF inflows reached their highest level since launch.

Ethereum is about to finish a move that might lead to a surge back to its peak of $4,868.

When ETF inflows are robust, Ethereum whales drive buying activity. Over the last five days, Ethereum whales have shown a range of on-chain behavior.

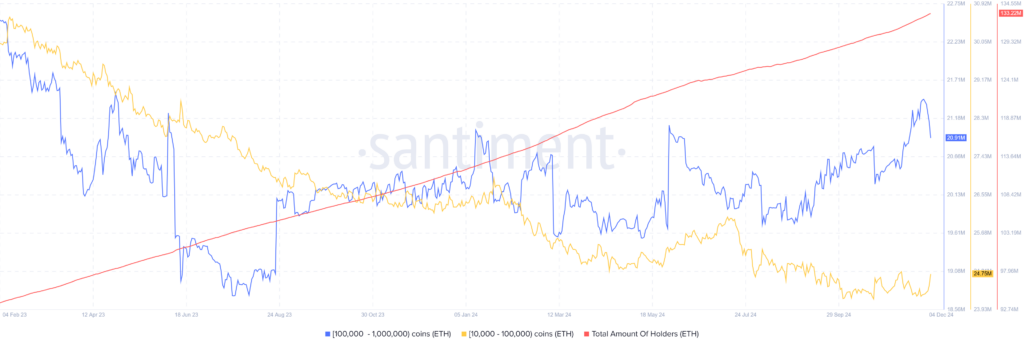

Whales with between 10K and 100K ETH increased their stash by 460K ETH, while those with between 100K and 1 million ETH reduced their holdings by 490K ETH.

On December 4, there were 133.21 million Ethereum holders overall, a sign of growing investor interest in the leading altcoin.

Source: https://www.fxstreet.com/cryptocurrencies/news/ethereum

In the meantime, US spot Ethereum ETFs reported net inflows of $132.6 million, which was the first time since their launch that they had seven days in a row with positive flows.

According to Coinglass data, despite a $3.42 billion exodus from Grayscale’s Ethereum Trust (ETHE), their net flows have risen to over $733 million in inflows due to the recent increase in institutional buying activity.

Ethereum Price Prediction: A pivotal trend move is imminent for ETH

Over $62.87 million in futures liquidations resulted from Ethereum’s 7% gain in the last day. $15.49 million and $47.38 million, respectively, came from liquidated long and short positions. A crucial symmetry triangle that extends from November 8, 2021, has a descending trendline resistance that Ethereum is testing.

ETH may complete a short-term rounded bottom move to test its all-time high resistance at $4,868 if it maintains a high volume move above this trendline.

Read more here about How BlackRock is planning to invest $9 trillion in XRP!