The price of Bitcoin has soared above the highly anticipated $100,000 mark, prompting speculation about how much higher it could go and whether it can overcome its infamous volatility. Shortly after 4:00 GMT on Thursday, the biggest cryptocurrency in the world surged to about $103,400 before dipping a little.

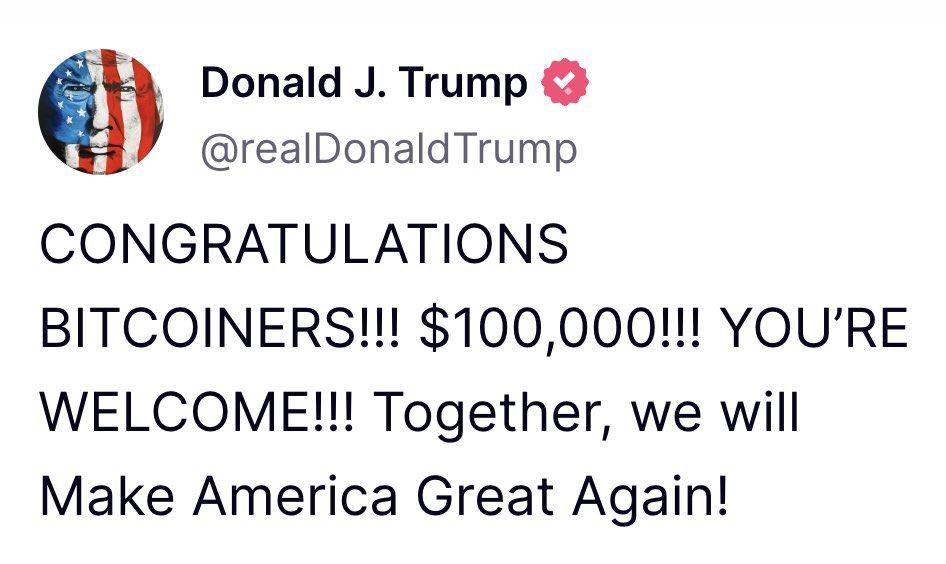

According to AJ Bell investment analyst Dan Coatsworth, the cryptocurrency experienced a “magic moment” and there was a “clear link” between it and Donald Trump’s election victory. Trump celebrated the milestone on social media by posting:

Here are 3 key reasons why Bitcoin hit $100K:

- Trump’s recent victory in 2024 elections

- Appointment of the new SEC Chair, Paul Atkins

- Bitcoin ETF and BlackRock

In a recent interview, Russia’s president putin said, “who can stop bitcoin, nobody”

Trump’s recent victory in 2024 elections

In order to help drive up the price of Bitcoin after he was elected president, the president-elect had previously promised to make the US the “crypto capital” and “Bitcoin superpower” of the world.

Bitcoin has risen over 130% so far this year, with a large amount of its gains coming from the post-election rally. Its performance is far superior to that of the S&P 500, which has increased by 28% during the same time frame.

Trump, who was once skeptical of cryptocurrencies, had referred to them as “not money,” saying they were “highly volatile and based on thin air.” In the months preceding his reelection, however, he made a complete 180-degree turn in an attempt to win over younger male voters, who are more likely than other demographic groups to own cryptocurrency.

“If crypto is going to define the future, I want it to be mined, minted and made in the USA,” Trump said in July at the largest crypto convention.

Appointment of the new SEC Chair, Paul Atkins

Paul Atkins, a pro-business former federal regulator who is supportive of the emerging cryptocurrency industry, was announced by President-elect Donald Trump on Wednesday as his nominee to head the Securities and Exchange Commission.

In a post on Truth Social, Trump declared that Atkins, a Republican who was a SEC commissioner under former President George W. Bush from 2002 to 2008, was his nominee. Trump referred to Atkins as a “proven leader for common sense regulations.“

Bitcoin ETF and BlackRock

Together with the other spot Bitcoin ETFs that made their debut on US exchanges on the same day, the BlackRock ETF on Bitcoin, which was developed and run by its affiliate iShares, entered the market on January 11, 2024.

For a number of reasons, IBIT has maintained record numbers since its inception. The first reason is that GBTC (Grayscale Bitcoin Trust), one of the ETFs introduced on January 11, had already existed but not as an ETF and had amassed an excessive amount of Bitcoin (more than 600,000) over the years.

“On November 15, 2024, the CFTC Division of Clearing and Risk issued a staff advisory related to clearing of options on spot commodity exchange traded fund,” The OCC said.

With $29 billion in inflows in 2024 alone, BlackRock’s IBIT ETF has already solidified its position as the leading player in the rapidly growing spot Bitcoin ETF market. This achievement is consistent with Bitcoin’s explosive ascent above $93,000 this year and the more than $27 billion that has been invested in spot Bitcoin ETFs overall.

Read more about BlackRock’s plan to invest $9 trillion to XRP coin.