Ripple’s XRP is a prominent digital asset that stands out in the vast universe of cryptocurrencies due to its focus on facilitating seamless global financial transactions. This guide provides a detailed breakdown of XRP, covering its inception, functionality, and technical details, catering to both beginners and advanced users.

What is Ripple’s XRP?

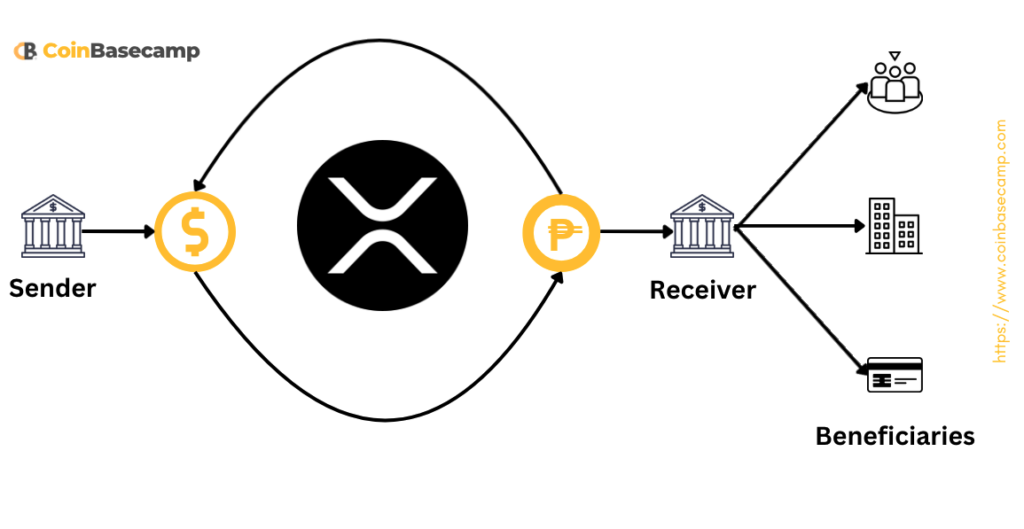

XRP is the native cryptocurrency of the Ripple network, primarily designed to enable fast and cost-effective cross-border transactions. Unlike Bitcoin, which focuses on decentralization and being a digital store of value, XRP aims to revolutionize the global payment system by bridging the gap between fiat currencies and blockchain technology.

When Did XRP Start?

Ripple was founded in 2012 by Chris Larsen and Jed McCaleb. The XRP Ledger (XRPL), the blockchain supporting XRP, was launched shortly after. It was created to address inefficiencies in the traditional financial systems, including high transaction costs and lengthy processing times.

Ripple Labs, the company behind XRP, aimed to develop a digital asset and blockchain solution that could work in harmony with the existing financial infrastructure, rather than replacing it entirely. This approach made XRP attractive to banks and financial institutions.

Motivation Behind the Ripple Project

The primary motivations for Ripple and XRP include:

- Speed: Reducing the time required for cross-border transactions, which can take several days in traditional banking systems.

- Cost-Effectiveness: Lowering transaction fees to make global payments accessible to more individuals and businesses.

- Interoperability: Creating a bridge currency that can seamlessly connect various financial systems and cryptocurrencies.

- Scalability: Ensuring the network can handle a high volume of transactions efficiently.

- Environmental Sustainability: XRP’s consensus mechanism is less energy-intensive compared to Bitcoin’s Proof of Work.

Ripple’s vision extends to creating an Internet of Value (IoV), where money can move as easily as information does today. This mission drives the continued innovation and adoption of the Ripple ecosystem.

How Does XRP Work?

XRP operates on the XRP Ledger (XRPL), a decentralized and open-source blockchain designed for payments. Unlike traditional blockchains, XRPL uses a consensus protocol rather than mining. Here’s how it works:

- Transaction Submission: Users submit transactions to the XRPL network.

- Consensus: Independent validator nodes (not miners) verify and agree on the transaction validity.

- Finalization: Once a consensus is reached, the transaction is added to the ledger and is immutable.

Key Features:

- Transaction Speed: Transactions settle in 3-5 seconds.

- Low Costs: Transaction fees are typically fractions of a cent.

- High Throughput: XRPL can process 1,500 transactions per second (TPS).

- Built-In Decentralized Exchange (DEX): XRPL includes a decentralized exchange that allows users to trade tokens directly on the ledger.

- Advanced Features: Supports features like escrows and multi-signature accounts for advanced financial operations.

The Blockchain Underpinning XRP

XRP operates on its proprietary blockchain called the XRP Ledger (XRPL). Unlike Proof-of-Work (PoW) blockchains, XRPL uses a consensus algorithm known as the Ripple Protocol Consensus Algorithm (RPCA). This system ensures:

- Fast Settlements: Validates transactions within seconds.

- Energy Efficiency: Minimal computational resources are required.

- Decentralization: Operated by a network of independent validators.

- Reliability: XRPL has been running without downtime since its inception in 2012.

The ledger’s design supports tokenization, allowing users to issue and manage custom tokens seamlessly. This capability opens opportunities for various applications, including stablecoins and tokenized assets.

Technical Table: Ripple’s XRP at a Glance

| Attribute | Details |

|---|---|

| Found Year | 2012 |

| Market Cap (2024) | ~$127 billion |

| Total Volume (24h) | ~$6 billion |

| Encryption Type | SHA-512 |

| Total Supply | ~$100 billion XRP |

| Market Supply | ~57 billion XRP (in circulation) |

| Transaction Speed | 3-5 seconds |

| Block Confirmation Time | N/A (uses consensus, not blocks) |

| Stability | High |

| Security | Advanced encryption protocols |

| Durability | Robust against failure |

| Community on Social Media | ~2 million followers across platforms |

Why Use XRP?

Advantages:

- Global Reach: Ideal for international remittances and cross-border payments.

- Cost-Efficient: Near-zero transaction fees.

- Liquidity Provider: Functions as a bridge asset between currencies.

- Integration with Financial Institutions: XRP is designed to complement traditional banking systems rather than disrupt them.

Use Cases:

- Banks: Enhancing interbank settlements.

- Payment Providers: Reducing operational costs.

- Individual Users: Affordable global money transfers.

- Central Bank Digital Currencies (CBDCs): Ripple is actively collaborating with governments to explore using XRPL for issuing CBDCs.

Ripple’s Biggest Customers

Ripple has established partnerships with several leading financial institutions. Here are three of its most prominent customers and how they are leveraging XRP:

1. Santander Bank

- Use Case: Santander uses Ripple’s technology, including XRP, through its One Pay FX platform for international payments. This enables faster transactions with greater transparency compared to traditional methods.

- Impact: Reduced transaction time from days to minutes and significantly lowered costs for cross-border remittances.

2. American Express (AMEX)

- Use Case: AMEX collaborates with Ripple to improve payment efficiency for corporate customers. Using RippleNet, AMEX connects businesses globally by enabling near-instantaneous transactions.

- Impact: Enhanced customer experience and streamlined financial operations.

3. SBI Holdings (Japan)

- Use Case: SBI leverages Ripple’s XRP for remittances and financial technology innovations in Asia. They also promote XRP adoption within Japan’s banking sector.

- Impact: Improved remittance services and expanded use cases for blockchain technology in regional financial institutions.

Challenges and Criticisms

While XRP has numerous advantages, it faces certain criticisms:

- Centralization Concerns: A significant portion of XRP supply is held by Ripple Labs, raising questions about decentralization.

- Regulatory Scrutiny: Ongoing lawsuits, such as the SEC vs. Ripple case, have impacted its adoption and market perception.

- Market Volatility: Like most cryptocurrencies, XRP’s price is highly volatile.

- Adoption Barriers: Despite its technological advantages, adoption by traditional financial institutions has been gradual.

Analysis Diagrams

1. Transaction Comparison (Speed and Cost)

[Diagram Placeholder]: A bar chart comparing transaction speeds and costs of XRP vs. Bitcoin and Ethereum. Highlight how XRP outperforms in speed and cost efficiency.

2. XRP Supply Dynamics

[Diagram Placeholder]: A pie chart illustrating the distribution of total XRP supply (Ripple Labs’ holdings vs. circulation). This diagram can also highlight escrowed XRP.

3. Global Adoption Trends

[Diagram Placeholder]: A world map showing countries with significant XRP adoption. Include notable partnerships and institutions using XRP.

Conclusion

Ripple’s XRP is a transformative cryptocurrency designed to address the inefficiencies of the traditional financial system. With its fast transaction speeds, low fees, and growing adoption by financial institutions, XRP holds significant potential. However, users should remain informed about its challenges and regulatory landscape when considering it as an investment or payment solution.

As Ripple continues to innovate and expand its ecosystem, XRP’s role in the evolving global financial system is likely to grow. For those seeking a digital asset with practical utility and robust technology, XRP remains a compelling option.