The world of finance is undergoing a revolutionary transformation, and Decentralized Finance (DeFi) is at the forefront of this change. DeFi represents a bold shift from traditional financial systems by leveraging blockchain technology to create a transparent, accessible, and decentralized ecosystem.

If you’re curious about how DeFi works and why it’s such a big deal, this article breaks it down for you.

What is DeFi?

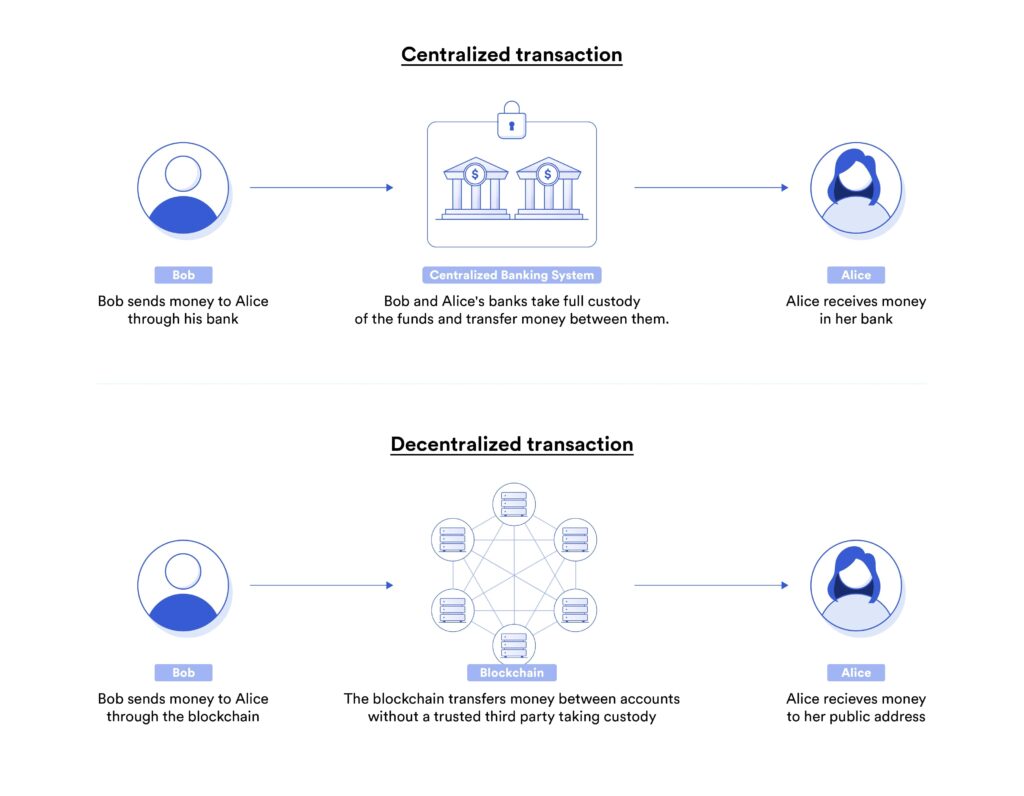

Decentralized Finance (DeFi) is a financial ecosystem built on blockchain technology, particularly Ethereum. Unlike traditional finance, which relies on banks, brokers, and centralized institutions, DeFi uses smart contracts—self-executing agreements coded on the blockchain.

This means you can lend, borrow, trade, and earn interest on assets without intermediaries. DeFi platforms are permissionless, meaning anyone with an internet connection can participate, making financial services more accessible to the unbanked or underbanked populations.

How Does DeFi Work?

DeFi operates through decentralized applications (DApps) and protocols that mimic traditional financial services but with key differences:

- Smart Contracts

- Smart contracts power DeFi, automating transactions based on predefined rules.

- For example, if you lock up crypto as collateral for a loan, the smart contract ensures the collateral is held until the loan is repaid.

- Decentralized Applications (DApps)

- DeFi apps, such as Uniswap and Aave, allow users to access services like trading, lending, and yield farming directly.

- These DApps are typically built on Ethereum but are expanding to other blockchains like Solana and Binance Smart Chain.

- Tokenization

- DeFi systems often rely on cryptocurrencies or stablecoins like USDC or DAI to facilitate transactions.

- Tokenized assets enable fractional ownership and increased liquidity.

Key Benefits of DeFi

- Financial Inclusivity

DeFi breaks barriers by enabling anyone with a smartphone and internet connection to access financial tools, regardless of location or credit score. - Transparency and Security

Transactions and smart contracts on blockchains are fully transparent, offering a level of trust unmatched by traditional financial systems. - High Yield Opportunities

DeFi provides competitive yields through mechanisms like liquidity pools, staking, and yield farming, often surpassing traditional banking rates.

Challenges Facing DeFi

While DeFi has many advantages, it is not without challenges:

- Scalability Issues: High transaction fees on Ethereum can be a barrier.

- Smart Contract Risks: Vulnerabilities in code could lead to hacks.

- Regulatory Uncertainty: Governments are grappling with how to regulate DeFi effectively.

Real-World Impact: DeFi vs. Traditional Finance

| Feature | DeFi | Traditional Finance |

|---|---|---|

| Accessibility | Global and permissionless | Restricted by geography, KYC, and credit |

| Intermediaries | None (smart contracts handle it all) | Banks, brokers, and other third parties |

| Fees | Low (except for Ethereum gas fees) | Often high and opaque |

| Transaction Speed | Fast (minutes to seconds) | Slower (hours to days for international) |

| Transparency | Full (public blockchain ledger) | Limited |

Conclusion: The Rise of DeFi

DeFi is disrupting traditional finance by offering a more open, transparent, and inclusive financial system. While it faces challenges such as regulatory scrutiny and technical risks, its potential to reshape the financial landscape is undeniable.

Whether you’re a crypto enthusiast or a newcomer, exploring DeFi could be your first step into the future of finance. With its ability to democratize financial access and innovation, DeFi is not just a trend—it’s a movement.

Tags: Decentralized Finance, DeFi Explained, Blockchain Technology, Cryptocurrency, Smart Contracts, Ethereum, Financial Innovation, DeFi Benefits