Key Points:

- Insiders withdrew $107 million just hours after launch, triggering a 94% collapse.

- The token briefly peaked at a $4.56 billion market cap before crashing.

- Argentine President Milei deleted his endorsement after backlash.

A Crypto Catastrophe: Libra Token’s Market Meltdown

The highly anticipated launch of the Libra (LIBRA) token, which was endorsed by Argentine President Javier Milei, has turned into a financial disaster. Within just three hours of trading, insider wallets reportedly siphoned out $107 million, leading to a staggering 94% drop in value and wiping out over $4 billion in market capitalization.

Also read: Crypto Revolution Ahead? David Sacks Teases Game-Changing Policy Shift

Insiders Cash Out Millions

According to on-chain intelligence firm Lookonchain, at least eight insider wallets linked to the Libra team executed liquidity removal tactics, withdrawing massive funds:

- $57.6 million in USD Coin (USDC)

- 249,671 Solana (SOL) worth $49.7 million

“The $LIBRA team has cashed out $107M! Eight wallets related to the $LIBRA team have obtained 57.6M $USDC and 249,671 $SOL ($49.7M) by adding liquidity, removing liquidity, and claiming fees,” Lookonchain reported.

From Soaring Highs to Rock Bottom

The Libra token skyrocketed to a peak market cap of $4.56 billion at 10:30 pm UTC on February 14. However, the rally was short-lived. Within just 11 hours, its value plummeted to $257 million, as per Dexscreener data.

The token initially surged in popularity following a now-deleted social media post by President Milei, which promoted a website and token contract address for Libra, described as a “private project” aimed at boosting Argentina’s economy.

Political Fallout & Milei’s Retraction

Following the market collapse, President Milei deleted his endorsement and later issued a strongly-worded statement, blaming political adversaries for exploiting the situation:

“To the filthy rats of the political caste who want to take advantage of this situation to do harm, I want to say that every day they confirm how vile politicians are, and they increase our conviction to kick them in the ass.”

Red Flags Ignored: Experts Warned Before the Crash

Before the meltdown, several blockchain analysis firms had raised concerns about LIBRA’s tokenomics:

- Bubblemaps revealed that 82% of the supply was unlocked and sellable from the start.

- The project failed to share preliminary tokenomics information, a major red flag in crypto trading.

Also read: Ethereum Set for Massive Surge: Could the Pectra Upgrade Push ETH to $10K?

Despite the risk, some experienced crypto traders managed to capitalize on the volatility of memecoins. On February 14, a savvy trader reportedly made $28 million in profit by investing in a “Broccoli” memecoin inspired by Binance co-founder Changpeng Zhao’s dog. However, speculation suggests the trader may have had insider connections.

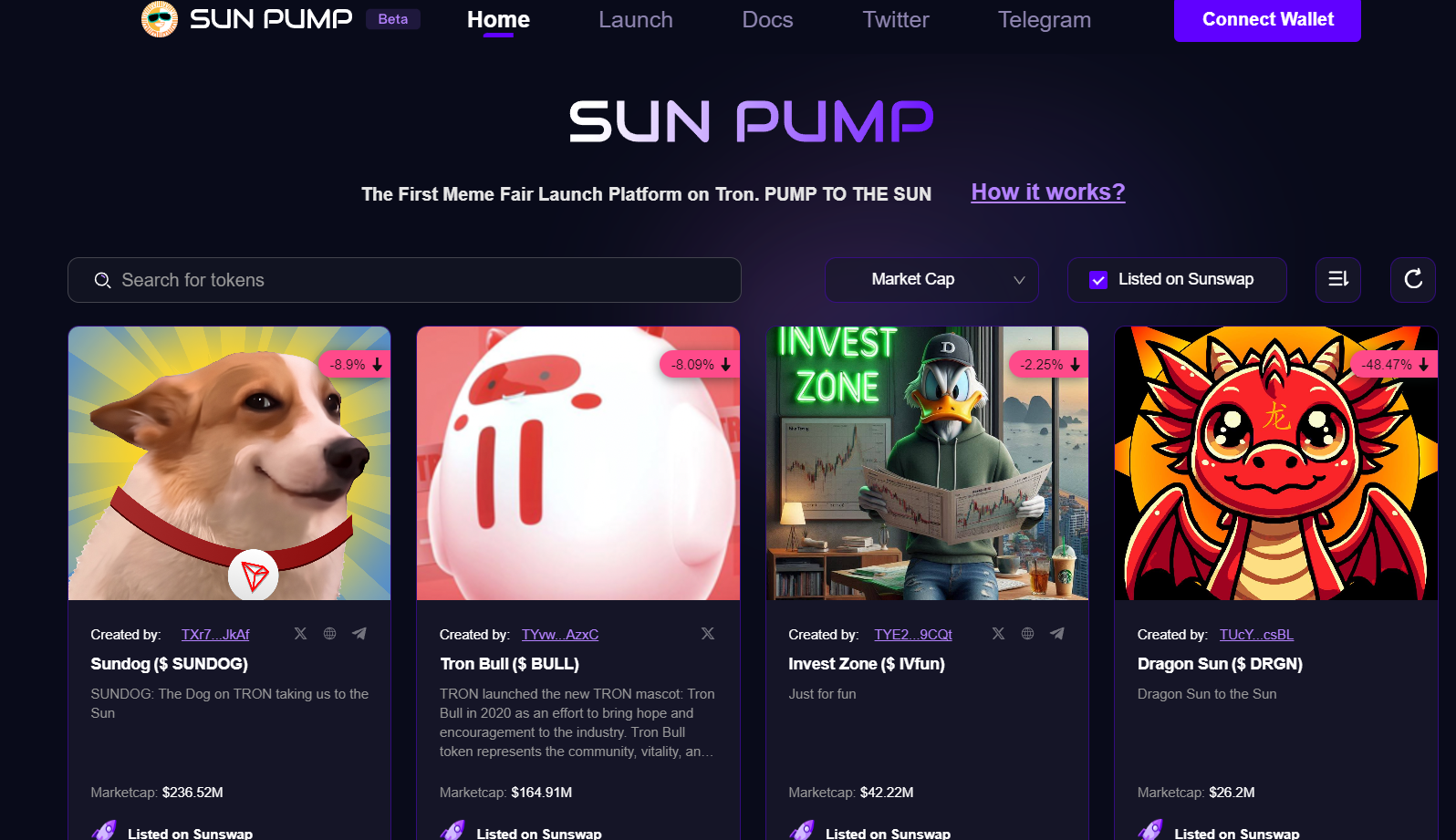

The Growing Trend of Political Memecoins

The Libra debacle follows a growing trend of celebrity and political figure-backed cryptocurrencies. Recently:

- Donald Trump launched his “Official Trump” (TRUMP) token on January 18.

- Melania Trump introduced her own “Melania Meme” (MELANIA) token on January 19 on the Solana network.

These politically tied memecoins have seen surging retail investor interest, despite their often volatile nature.

Conclusion: Another Lesson in Crypto Volatility

The Libra token crash serves as yet another cautionary tale in the world of high-risk cryptocurrency investments. With political figures lending their names to projects, retail investors must remain vigilant and conduct thorough research before diving into the hype-fueled memecoin frenzy.

As crypto markets continue to evolve, the balance between opportunity and risk remains as unpredictable as ever.