Crypto Market Crash with Over $400 Million Liquidated: The Storm Behind Bitcoin, ETH, XRP, DOGE, SOL, and SUI Decline

Key Takeaways:

- Over $400 Million Liquidated: Massive sell-offs across Bitcoin, Ethereum, and other top cryptocurrencies.

- Macro Economic Headwinds: Stronger jobs data dashes hopes for U.S. Fed rate cuts, fueling market uncertainty.

- Whales and Institutions Exit: Large holders and funds liquidate holdings, triggering cascading losses.

Market Meltdown: Over $400 Million in Liquidations

The crypto market faced a sharp downturn during early U.S. trading hours on Monday, with over $400 million in cryptocurrencies liquidated within 24 hours. According to Coinglass data:

- Nearly 170,000 traders were liquidated, including a single BTCUSDT order worth $8.21 million on Binance.

- Long positions accounted for $330 million of the liquidations, while short positions contributed $70 million.

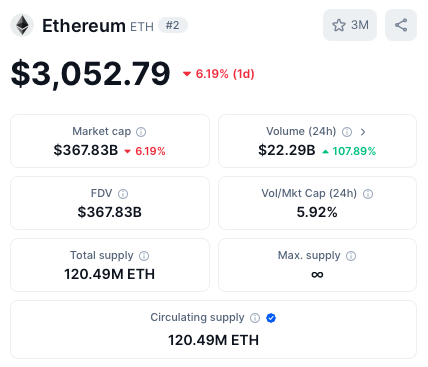

The global crypto market cap dropped over 2%, sliding from $3.34 trillion to $3.21 trillion. Bitcoin (BTC) and Ethereum (ETH) prices flirted with key support levels, while altcoins like XRP, Solana (SOL), Dogecoin (DOGE), and Shiba Inu (SHIB) faced declines between 3% and 8%.

Macro Headwinds: The Perfect Economic Storm

Stronger-than-expected U.S. jobs data has dampened market sentiment, signaling a robust economy that allows the Federal Reserve to maintain higher interest rates.

- Economic Indicators:

- The U.S. dollar index (DXY) soared past 110, its highest since 2022.

- The 10-year Treasury yield climbed to 4.8%, the highest level in over a year.

- Rate Cut Delays: Wall Street analysts from Goldman Sachs and Bank of America now expect the Federal Reserve to delay interest rate cuts until next year.

This economic backdrop has added pressure on crypto markets, with key events like CPI inflation and unemployment data expected to create further turbulence in the coming week.

Whales and Institutions Fuel the Sell-Off

Whales and institutional investors appear to be accelerating the market downturn by liquidating large holdings.

- Bitcoin price fell below the crucial $92,000 support level, with risks of a further decline to $80,000.

- Ethereum saw a sharp sell-off, with Tron founder Justin Sun alone depositing over $320 million worth of ETH to exchange HTX in the last 13 hours.

Additionally, Bitcoin’s network activity has hit its lowest level since November 2024, and short-term holders are selling assets at a loss. XRP and other altcoins face similar pressures, with uncertain outlooks despite recent technical patterns.

Conclusion: Turbulent Waters Ahead

The crypto market remains on shaky ground as macroeconomic headwinds, whale sell-offs, and institutional exits create a perfect storm. With critical economic data on the horizon, investors should brace for potential volatility and monitor key support levels across the market.